Content

When a company receives upfront payment from a customer before the product/service has been delivered; it is considered as deferred revenue. In short, Deferred revenue is recognized after cash is received. Because Direct Delivery received $10, it must debit the account Cash. The second account will be Service Revenues, an income statement account.

- When variable consideration is present in a contract, the standard allows the variable component to be allocated to specific performance obligations if certain criteria are met.

- To test whether a cost should be capitalized or expensed, consider whether that cost would still be incurred if all parties walked away just prior to signing the contract.

- Because the revenue is recognized at that moment, the related expense should also be recorded as can be seen in Journal Entry 4B.

- When transfer of ownership of goods sold is not immediate and delivery of the goods is required, the shipping terms of the sale dictate when revenue is recognized.

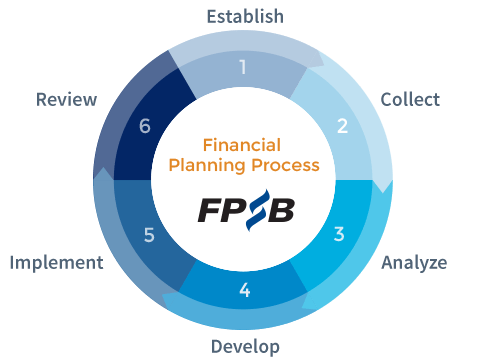

For companies of all sizes, both public and private, revenue recognition is an important concept to understand fully. It is critical for businesses to look strategically at revenue recognition policies to ensure they are compliant now and are conducive to the company’s future financing, filing and expansion goals. The agency completes and delivers the website in the first month, leading to a ledger update – even if they have not been technically paid by the client yet. As soon as it’s delivered, the performance obligation is considered fulfilled. In order to standardize processes around revenue recognition, the FASB released ASC 606, which provides a five-step framework for recognizing revenue. Accurate revenue recognition is essential because it directly affects the integrity and consistency of a company’s financial reporting.

Horngren’S Financial And Managerial Accounting

Capitalized incremental costs to obtain a contract should be presented as a single asset and classified as long-term unless the original amortization period is one year or less. Generally, the amortization of costs of obtaining a contract that are capitalized should be amortized and reported as expense within the selling, general and administrative section of the income statement. Contract assets and contract liabilities should be presented as current and noncurrent in a classified balance sheet, and determined at the contract level. Contract assets and liabilities for each performance obligation within a single contract should be reported on a net basis.

- It is critical for businesses to look strategically at revenue recognition policies to ensure they are compliant now and are conducive to the company’s future financing, filing and expansion goals.

- Under ASC 606, not all of the contract revenue will be recognized upfront even if the company has been paid in full.

- Hiring a virtual accountant means you’re only paying for services on a “needs” basis.

- If there was a debit of $5,000 and a credit of $3,000 in the Cash account, we would find the difference between the two, which is $2,000 (5,000 – 3,000).

The proprietor no longer has any responsibility for or control over the goods. In the example of groceries purchased, the reward is the realization of the cash received from the sale. Prior to the sale, the risk to the vendor is that the food products may pass their sell-by date or may not be saleable due to changes in consumer tastes. Once you have purchased the goods, you are accepting responsibility for consuming the product prior to the sell-by date. Thus, the rewards have been transferred to the seller and the risks have been transferred to the buyer.

Revenue Recognition: What It Means in Accounting and the 5 Steps

K’s Bounce House Adventures rents bounce houses to individuals and corporations for parties. K’s has the following transactions during the month of February. Contract arrangements typically include myriad criteria that may affect the application of the ASC 606 revenue recognition standard.

Many companies voluntarily follow IFRS guidelines, but in some 144 countries that have mandated IFRS, these accounting practices are a legal requirement for financial institutions and public companies. Independent contractors also face a perplexing accounting situation, because when they are paid often varies. If the amount received is the proceeds from the company signing a promissory note, the account to be credited is Notes Payable. Let’s identify the two accounts involved and determine which needs a debit and which needs a credit. Insurance companies often require payment upfront for the coverage period. For example, a homeowner may pay a lump sum for a one-year insurance policy. Landlords collect rent in advance, typically on a monthly basis.

Cash vs Accrual Accounting: Speaking The Language of Business

Salaries are an expense to the business for employee work. Expenses increase on the debit side; thus, Salaries Expense will increase on the debit side. Cash was used to pay the dividends, which means cash is decreasing. https://business-accounting.net/ Cash was used to pay the utility bill, which means cash is decreasing. This is a transaction that needs to be recorded, as Printing Plus has received money, and the stockholders have invested in the firm.

- It can also affect your tax liability and investment opportunities.

- Same as revenues, the recording of the expense is unrelated to the payment of cash.

- In addition, these topics are frequently discussed in SEC staff speeches at the annual AICPA & CIMA Conference on Current SEC and PCAOB Developments.

- Considered a short-term liability on the balance sheet because you still owe services.

- We know from the accounting equation that assets increase on the debit side and decrease on the credit side.

- Think construction contracts or the provision of maintenance over a period of time.

The unearned income is deferred and then recognized to income when cash is collected. For example, if a company collected 45% of a product’s sale price, it can recognize 45% of total revenue on that product. The installment sales method is typically used to account for sales of consumer durables, retail land sales, and retirement property. Examples of costs that are expensed immediately or when used up include administrative costs, R&D, and prepaid service contracts over multiple accounting periods. As specified byGenerally Accepted Accounting Principles , accrued revenue is recognized when a performance obligation is satisfied by the performing party.

Journal entry for cash received for services not yet performed

Some of the more challenging and judgmental aspects of applying the revenue standard are highlighted below. To the percentage of completion method, the completed contract method only allows revenue recognition when the contract is completed. Amount – The amount to be recognized on the journal entry for this line. Big Company satisfies performance obligation 1 – product A being delivered to Mr. Customer.

What is the accounting treatment for revenue recognition?

Generally accepted accounting principles (GAAP) require that revenues are recognized according to the revenue recognition principle, a feature of accrual accounting. This means that revenue is recognized on the income statement in the period when realized and earned—not necessarily when cash is received.

The intent of the guidance around revenue recognition is to standardize the revenue policies used by companies. This standardization allows external entities — like analysts and investors — to easily compare the income statements of different companies in the same industry. Because revenue is one of the most important measures used by investors to assess a company’s performance, it is crucial that New Revenue Recognition Journal Entry financial statements be consistent and credible. The revenue recognition principle is a key component of accrual-basis accounting. This accounting method recognizes the revenue once it is considered earned, unlike the alternative cash-basis accounting, which recognizes revenue at the time cash is received. In the case of cash-basis accounting, the revenue recognition principle is not applicable.

2.5. Recognize Revenue When (or as) the Entity Satisfies a Performance Obligation

Another example is a liability account, such as Accounts Payable, which increases on the credit side and decreases on the debit side. If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500. The credit is the larger of the two sides ($4,000 on the credit side as opposed to $2,500 on the debit side), so the Accounts Payable account has a credit balance of $1,500. Dividends distribution occurred, which increases the Dividends account. Dividends is a part of stockholder’s equity and is recorded on the debit side. This debit entry has the effect of reducing stockholder’s equity. Paying a utility bill creates an expense for the company.

The subscription accounting treatment allocates appropriate costs needed to meet your performance obligation. Topic 606 principal vs agent is an examination of third-party sales in SaaS revenue recognition. A third party would be anybody that provides goods or services to your customers. Evaluating whether you are a principal vs agent takes place when reviewing performance obligations in the ASC 5 steps. ASC 606 rules guide revenue from contracts with customers. Many SaaS organizations lean on Topic 606 for reporting guidance.